Worldwide chargeable air cargo weight declined -1% in week 19 (May 5-11) compared to the previous week, according to the latest Air Cargo Market Trends report from WorldACD Market Data.

The research company noted this result marks a string of contractions since the first week of April that was only interrupted by stable volumes in week 17.

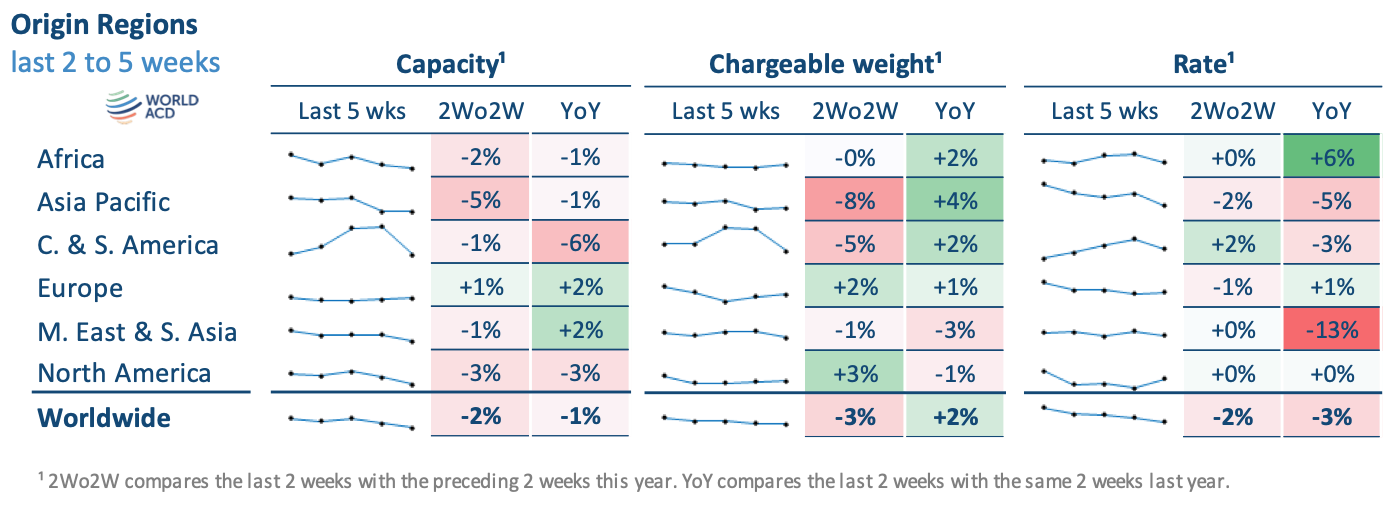

The comparison of the last two weeks with the previous two weeks (2Wo2W) shows a worldwide tonnage decline of -3%. Europe and North America were the only origin regions to see traffic growth with +2% and +3% respectively, partly related to post-Easter recovery for those origins.

Already struggling from the impact of the trade war on airfreight flows, demand was further hit by the end of the US ‘de minimis’ exemption, which caused double-digit percentage drops in China origin volumes to the US.

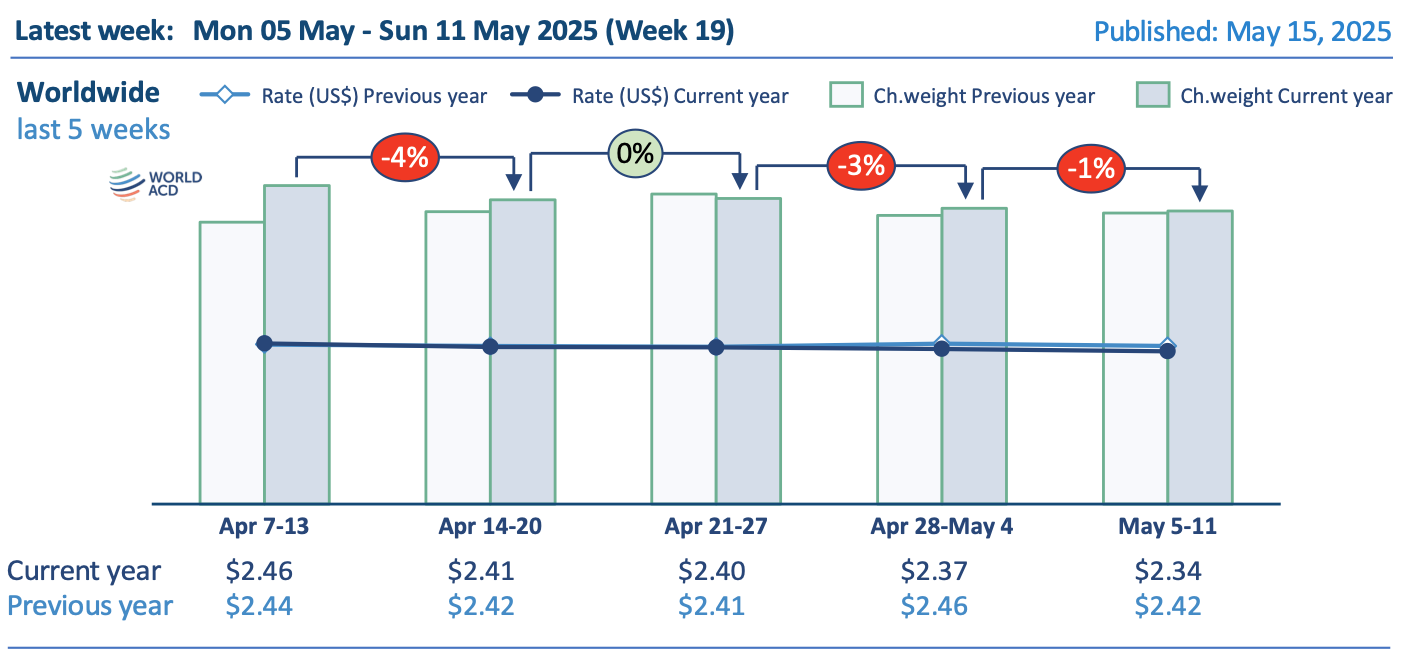

As a result of weakening demand, the data shows the global average rate retreated for a fourth week in a row, dropping from US$2.46 in week 15 to US$2.34, a -2% decline from week 18.

On a 2Wo2W comparison the global average rate was also down -2%, based on over 500,000 weekly transactions covered by WorldACD’s data.

This was -3% lower than in week 19 of 2024, showing an increasing gap in year-on-year comparisons. North America and Europe, up +3% and +1% week on week respectively, were the only origin regions to show increases in pricing, partly related to post-‘Labor Day’ (May 1) holiday recovery.

The decline in chargeable weight on a 2Wo2W basis was led by the Asia Pacific region (-8%), followed by Central and South America (CSA), where the end of the flower export spike for Mother’s Day resulted in a -5% drop in volume.

Exports from the Middle East and South Asia (MESA) region slipped -1%, which WorldACD observed is likely as a result of the geopolitical tensions in the region, while volume out of Africa was flat.

Growth in the westbound transatlantic market, with 2Wo2W chargeable weight up +6%, has been fuelled, it said, by front-loading during the pause in tariffs.

The Asia Pacific region shows 2Wo2W declines in all sectors, with volumes to North America and within the region falling -13% and -12% respectively, reflecting uncertainty over tariffs and a pause in traffic from ‘Labor Day’ (May 1) and ‘Golden Week’ (April 29- May 6) holidays.

A combination of factors exerted downward pressure on pricing, most prominently uncertainty over US tariffs, which slowed economic activity and caused firms to postpone strategic sourcing and investment decisions.

On a 2Wo2W basis pricing declined most notably ex-North America to Asia Pacific (-5%), ex-Asia Pacific to North America (-4%), and ex-Europe to North America and CSA (both -3%).

The slump in container shipping pushed down box rates, making airfreight less appealing to shippers, WorldACD noted.

One stabilising factor was airfreight capacity, which contracted -2% globally 2Wo2W. With the exception of Europe, which registered +1% more lift, all other regions saw capacity decline, led by a -5% drop in the Asia Pacific region.