Air cargo demand has proved surprisingly strong so far this year, which no one saw coming, admitted Niall van de Wouw, Chief Airfreight Officer of Xeneta, and no one knows how long this will continue.

Xeneta was hosting the quarterly update in partnership with The International Air Cargo Association (TIACA) for the first time, with Director General Glyn Hughes joining the call to give his perspectives.

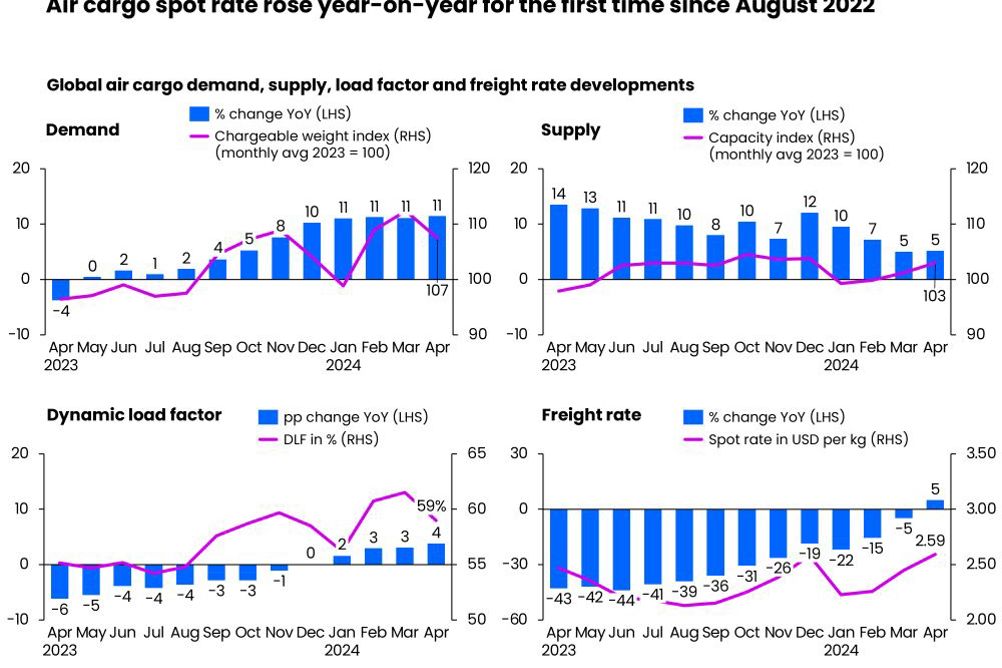

April was the fourth month in a row to register year-on-year growth of 11% and continues a trend which has been noticeable since late last year.

At the end of last year, no one would have predicted such strong figures compared to last year, said van de Wouw.

Capacity has been increasing at a lower rate, up 5% year-on-year in April, which has put the global dynamic load factor up four percentage points in April to 59%.

Last year, the story for airfreight rates was year-on-year falls exceeding 40% due to rising capacity and weak demand.

April this year was the first month since August 2022 when rates increased year-on-year, up 5% to a global average of $2.59 per kg.

“For many players except the shippers, this is a positive sign of a very resilient market. The rates continue to grow and we see rates in April higher than in October and November, which is remarkable,” commented van de Wouw.

Hughes added that he has spent a lot of time in Latin America and Africa recently, and the strength of demand is staggering, he said.

In the three weeks prior to Mother’s Day, there were high volumes of flowers out of key cities such as Bogota, Quito, Nairobi and Addis Ababa.

The questions is how long this will last as flowers are replaced by other perishables, along with e-commerce growth.

He said, “The e-commerce demand is taking up so much capacity that it is making the rest of the capacity quite tight. I think that is why we are seeing an increase in rates and the dynamic load factor with the stabilisation of capacity on the supply side, it is looking incredibly healthy.”

Van de Wouw agreed that e-commerce is important, combined with the Red Sea largely being closed for shipping, which is causing detours around the Cape of Good Hope.

The Red Sea disruption is affecting traffic from Asia Pacific to the Middle East and Europe, both registering load factors around nine percentage points above last year, pushing load factors to the mid-80% range.

From the Middle East and Central Asia, load factors on routes to Europe were up 13 percentage points in April to 80% and 18 percentage points to North America to 78%.

When the dynamic load factor exceeds 80%, van de Wouw says the market swaps from being a buyers’ market to a sellers’ market.

Hughes pointed out that travelling around the Cape of Good Hope adds up to two weeks sailing time each way on routes between Asia and Europe, which has more than doubled TEU costs in some cases.

The return of empty containers is taking up to four weeks, with Hughes saying, “We have had reports of a lack of containers meaning cargo can’t get to the ports in some parts of China and south east Asia. That is a secondary push to air because they can’t wait for containers to come back into the distribution cycle.”

Rates shoot up

Wenwen Zhang, Airfreight Market Analyst at Xeneta provided insights into trade lanes, starting with the transatlantic, where capacity has recovered.

The gap between spot rates and seasonal rates have narrowed and are both going down.

Spot rates have been above seasonal rates since October due to carriers reducing their schedules for winter, which has been reversed as they launch summer schedules.

Asia to Europe has been heavily disrupted by geopolitical events with air rates from India to Europe going from around $1.50 per kg to almost $4 per kg between October and April, and from around $2 per kg to around $4.50 per kg from Bangladesh.

At the same time, the ocean schedule reliability has plummeted from just below 80% to 42%.

Hughes said he is often asked whether this disruption will put rates back to the pandemic highs, to which he says no because the market has belly capacity that was unavailable during the pandemic and there are more freighters in the market.

Days after the Red Sea crisis started, van de Wouw said journalists were asking whether rates were picking up and at first, volumes increased while rates remained stable at first before surging, which he believes was driven by apparel companies.

India, Sri Lanka and Bangladesh are large producers and companies were concerned that their products would not be in the shops in time for Spring.

“What one of them told me is the delay out of north east Asia to Europe is seven to ten days but for this part of the world it is closer to 14 days,” said van de Wouw, which meant many believed the extra cost of airfreight was worth it compared to discounting products when they are out of season.

Spot rates in south Asia are levelling off because shippers are accepting longer ocean journeys, said Zhang, which means air demand has peaked.

They are likely to come down and we will have to wait and see if or when they return to pre-Red Sea rates.

On the transpacific lane, e-commerce continues to elevate spot rates from southern China and Hong Kong.

Out of southern China, spot rates to the US are 58% higher than last year, and rates out of Hong Kong are up 6%.

Normally rates out of Hong Kong are higher but that is not the case due to e-commerce volumes out of southern Chinese cities such as Guangzhou and Shenzhen.

Hughes says around 20% of global volumes are e-commerce and out of China and Hong Kong, it is between 60 and 70%.

What is more amazing is that we are only just getting started, said Hughes, with e-commerce platforms already predicting that they will need even more capacity from the third quarter of this year.

“Temu and Shein are opening up new markets on top of traditional players. We have also got TikTok Shop so as we go to Q3 and Q4, we can expect to see demand for e-commerce coming out of Hong Kong and south east China will be a factor for overall demand,” said Hughes.

Hughes speculated that the high rates could cause freighters to be moved from the transatlantic lane to the transpacific to cater for this demand.

Zhang added that belly capacity between China and the US is less than 30% of pre-pandemic levels.

Ocean reliability is also poor on the transpacific and rates have surged since the start of the year, putting them 141% above last year by the start of May for a 40 foot container.

Looking ahead, there are labour negotiations later this year, which could cause disruption if there are disagreements.

The Panama Canal has affected transpacific ocean services, with low water levels caused by drought conditions limiting the number of ships that could use the canal.

Now it is almost raining too much so a normal number of ships will be able to use the Panama Canal again soon.

That will ease pressure on US west coast ports, which was creating issues for road and rail freight services.

Where are we going?

Global manufacturing is in expansion mode, according to the Manufacturing Purchasing Managers’ Index (PMI), which is a key indicator of global trade.

In advanced economies, especially Europe, the PMI remains below 50, which indicates contraction.

New export orders indicate growth especially out of mainland China and India, returning to growth following two years of contraction.

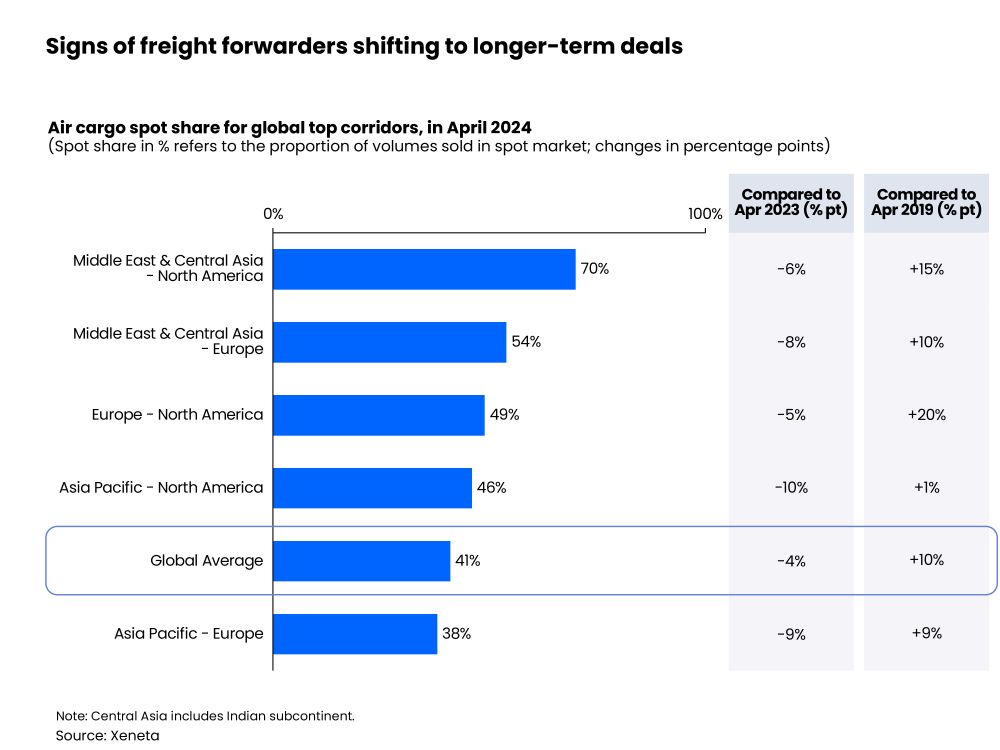

The way to understand how shippers and forwarders view the market is to view the deals they are making, said van de Wouw.

They are making more short-term contracts and long-term contracts are out of favour due to the Red Sea disruption and rising e-commerce volumes.

In Q1 of 2023, 7% of contracts were more than six months, rising to 39% in Q3 and back down to 18% in Q1 of 2024.

The percentage of contracts valid for three to six months has gone from 34% in Q1 of 2023 to 18% in Q3 to 34% in Q4 then down to 11% in Q1 of 2024.

Contracts valid for one to three months have gone from 23% in Q4 of 2023 to 41% in Q1 of 2024 and contracts valid for up to one month went from 16% in Q3 to 24% in Q4 to 29% in Q1.

Van de Wouw said there were few long-term deals during the pandemic, which changed as the market calmed down and shippers and forwarders found more common ground to enter long-term agreements.

The Red Sea disruption and e-commerce growth made them uncomfortable entering long-term contracts so they are entering medium-length contracts to see how the market develops.

He says shippers and forwarders are taking a wait and see approach, adding, “What we see as a response to this uncertainty is and less need to gamble when it comes to entering a fixed deal is shippers and forwarders coming up with indexed type deals. They are looking for mechanisms to still have a longer term deal but share the risk of this volatility in a fair manner.”

This is coming from shippers in all sectors and from freight forwarders to minimise the workload, giving shippers competitive rates throughout the contract and give freight forwarders stability and more predictable volumes.

Van de Wouw adds that this means shippers do not need to go to tender every time the market is disrupted by external events.

Between airlines and freight forwarders, it is the opposite with spot rates falling four percentage points compared to April last year, with a global average of 41%. This is 10 percentage points above April 2019.

Airlines and freight forwarders are looking for longer term deals, which van de Wouw says is because freight forwarders found themselves in a difficult position last year when they were procuring on the short-term market and they had long-term commitments at low rates, which meant contracts had to be re-negotiated.

Shippers, airlines and forwarders are already looking to the peak season, wondering what the likes of Temu and Shein will do.

Airlines and freight forwarders are discussing longer term deals for that period, said van de Wouw.

Freight forwarders are in a less risky position due to greater alignment between the contracts they buy and sell.

Van de Wouw concluded, “For freight forwarders and airlines, it is a strong market. We see people are adjusting and becoming more agile in response to these changing conditions but also looking for mechanisms that will make it more productive and efficient in dealing with these ever-changing conditions rather than ripping up contracts and re-negotiating and going out to market again.”

This article was published in the June/July 2024 issue of Air Logistics International, click here to read the digital edition and click here to subscribe.