Cargo volumes fell again in February, down 4% year-on-year and capacity was up for the 11th consecutive month, up 11%.

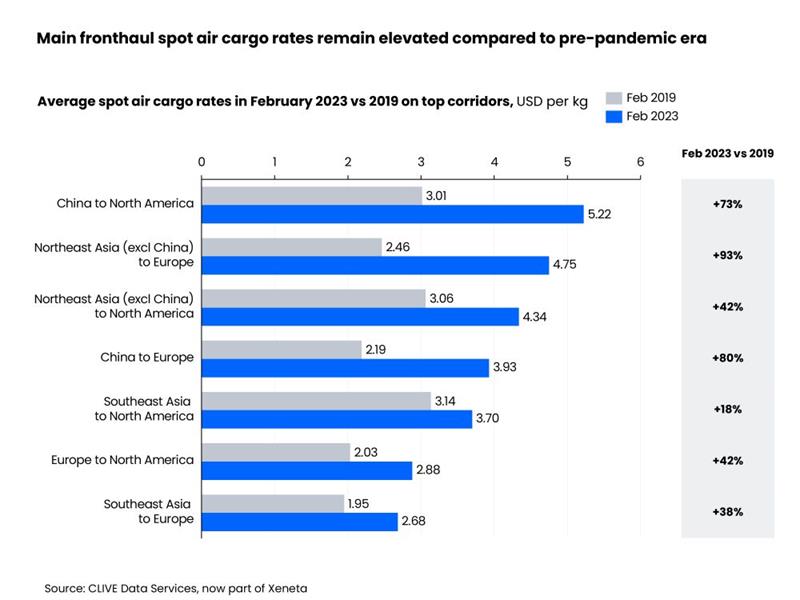

The global average airfreight spot rate declined 35% to $2.73 per kg but the average is still 52% above pre-pandemic levels of 2019.

Niall van de Wouw, Chief Airfreight Officer of Xeneta says comparisons to pre-pandemic times were useful during the pandemic but the fascination with 2019 needs to be replaced with current looking at circumstances.

He says, “Name me a service or product that you acquired four years ago that you’re still paying the same price for now? The air cargo industry should be focused on where growth is going to come from because the general air cargo volumes have seen negative growth for four years, and based on the first two months of 2023 are still -8% in terms of chargeable weight compared to four years ago. That is not a growth market.”

Van de Wouw added that 2019 was a relatively weak year after a buoyant 2018.

Looking ahead, he says volumes are limited, flights are less full and more capacity will come as summer flight schedules commence so he does not see fundamental changes that will help the current market conditions.

He says, “There is a hope and expectation of volumes increasing in Q3 as companies restock, but when I talk to shippers, I don’t hear anyone saying they’re going to ship more airfreight. If restocking comes, many shippers will look firstly to use cheaper modes of transport and, from where we are now, even if there is a boost, we might still be seeing zero overall growth for general air cargo by later in the year.”