In August, global spot rates were $2.19 per kg, the lowest level since the start of the pandemic and chargeable weight was down 1%.

Capacity was up 7% year-on-year and the load factor was down 3% to 56% due to softening global demand and capacity growth.

Niall van de Wouw, Chief Airfreight Officer of Xeneta says it could be a few quarters before demand picks up globally and there are few signs that there will be a peak this year.

He adds that the ocean market, which precedes airfreight by a couple of months, had no peak season and even had blank sailings scheduled ahead of the Golden Week period.

“There is likely to be upward pressure on airfreight rates in the second half of October as capacity is taken out of the market, but it’s getting late in the game to positively impact the industry’s 2023 performance, and the signals for the rest of the year are not good given the macroeconomic outlook hasn’t improved,” he says.

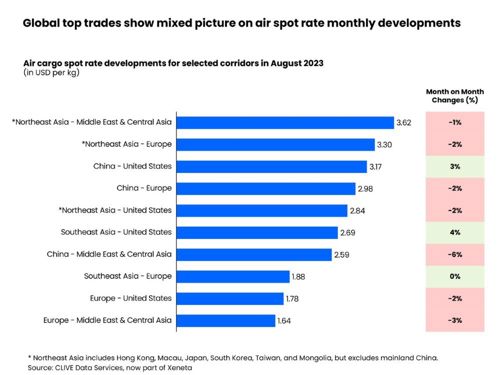

Average general airfreight rates dipped as low as $2.13 per kg in early August, with only the China-US and Southeast Asia-US trade lanes recording rising spot rates, up 3% and 4% respectively.

Capacity shortages triggered by geopolitical issues means spot rates from Northeast Asia to Middle East and Central Asia, Northeast Asia to Europe, China to the US and China to Europe are still around 55% higher than pre-pandemic levels.

Van de Wouw says, “Whichever way you choose to look at it, demand growth simply does not exist in this current moment or for the foreseeable future. Shippers will no doubt be tempted to fix more longer-term deals because the levelling of volumes and the imminent drop-off of some capacity means the market may not get any better than it is right now for capacity buyers.”