In its monthly report, CLIVE reports that capacity rose 8% year-on-year in June and global chargeable weight dropped 1%, similar to May’s performance, but spot rates were down 41% to $2.31 per kg.

The slowing decline in volume and slower capacity growth compared to previous months provided protection against a big drop in the dynamic load factor, which was down 3 percentage points year-on-year to 56% and had a 1 percentage point recovery compared to May.

Niall van de Wouw, Chief Airfreight Officer of Xeneta says the biggest surprise in June is the difference between the market sentiment and what the data shows, saying, “It is getting pretty nasty out there and stress levels among airlines and forwarders are clearly rising, but we see a clear distinction between market sentiment and market fundamentals and sentiment is more negative right now.”

He adds, “Airlines and forwarders are getting jumpy because of falling rates, not so much the volumes. It’s the fear-of-missing-out that is driving the aggressive drop in cargo rates because no one wants to lose volumes, and they also want to get more of the cargo that’s in the market. We can see forwarders taking big risks.”

On major corridors, spot rates from northeast Asia to Europe were $3.25 per kg, down 55% year-on-year and northeast Asia to the US rose 3% month-on-month to $4.19 per kg, which is down 49% on a year ago.

Europe to the US spot rates had the largest decline, down 14% month-on-month to $1.92 per kg and down 45% on last year, making it the only corridor where spot rates fell below the seasonal rate.

The market appears to be more pessimistic, says CLIVE, with some freighter airlines reviewing their route and capacity as demand for all-cargo aircraft returns to pre-pandemic levels due to recovering belly capacity.

Freight forwarders are still locked into high airfreight rates under blocked space agreements with airlines while facing pressure from shippers to negotiate rates down to the new market level, inspired by aggressive pricing policies of other forwarders trying to gain volumes.

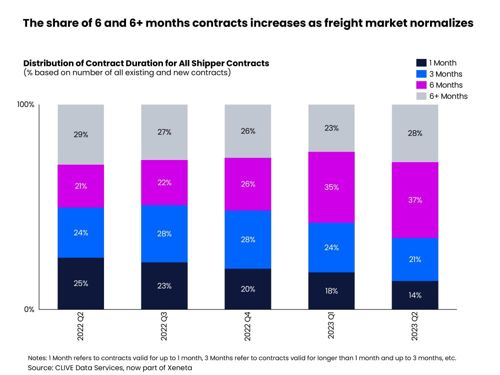

The data shows 6-month and 6+-month contracts gaining more grown with the former proving most popular and the latter gaining popularity while spot rates have shrunk from 25% of the market in the 2nd quarter of 2022 to 14% this year.

Van de Wouw says the current market is a toxic mix with forwarders agreeing to 12-month fixed rates with shippers, including fuel, that are lower than the rates seen the in the market overall.

He comments, “That is nearly ‘going to Vegas’ in terms of risk, but forwarders are anxiously looking to secure volumes in the face of fierce competition.”

In general, shippers are not looking for a massive overhaul in their supplier base, says van de Wouw, but do want to see a benefit because rates and market conditions are lower than 6-9 months ago.

The question now is whether carriers pursue margins or volumes with airlines not wanting to fly empty and recognising that they keep their rates high, they will not get the volume.

Van de Wouw says, “Two years ago, airlines were asking ‘what am I going to do with my belly aircraft’ and now it’s a case of ‘what am I going to do with my freighters?’. It's going to be a long summer for airline cargo departments, and it looks as though it will take a few quarters for the market to move away from the current irrational pricing environment.”