The data says airfreight volumes increased 2% year-on-year in October, which is sub-seasonal compared to the previous 5 years.

General air cargo spot rates were up 2% to $2.28 per kg, rising above seasonal rates for the first 2 weeks of October before falling below seasonal levels.

They declined at their slowest pace for a year, down 30% helped by a slight uptick in global volumes and a slowdown in cargo capacity growth in a month in which global belly capacity returned to its pre-pandemic levels with regional variations.

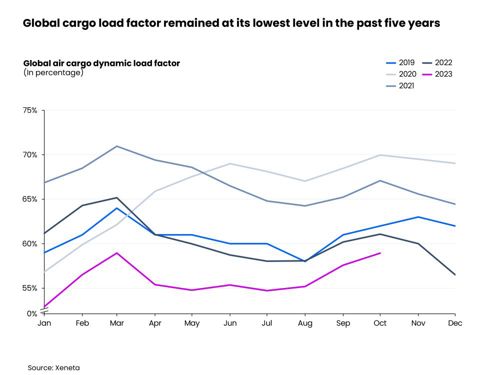

The global dynamic load factor was 59%, 2 percentage points below last year.

Across the first 10 months of 2023, load factors have been well below the average for the last 5 years, pointing to a persistently weak global air cargo market.

Niall van de Wouw, Chief Airfreight Officer of Xeneta says the marginal improvements in October are neither a cause for optimism nor pessimism and carriers and forwarders are not expecting the market to significantly improve until the second half of 2024.

The ongoing war in Ukraine and the conflict in Israel and Gaza only add to concerns, he says.

“This is a volatile market. Freight forwarders are still procuring capacity on a short-term basis but are selling more long-term. That’s a risk, but clearly forwarders are not willing to commit to capacity because of so much uncertainty,” says van de Wouw.

Global carriers registered declining revenue in October but are still averaging more than 20% higher than 2019 due to rates staying high for premium and special cargoes while general cargo has returned to pre-pandemic levels.

Jet fuel costs are elevated with US Gulf Coast jet fuel spot rates 55% above 2019 levels in the first 3 weeks of October and rising labour costs caused by high inflation and labour shortages are affecting operating costs.

On specific lanes, spot rates from Europe to the US were up 7% to $1.85 per kg due to the market anticipating reduced capacity as available space is influenced by passenger schedules.

From east to west, spot rates from China to Europe climbed 14% month-over-month to $3.66 per kg and south east Asia to Europe were up 9% to $2.51.

Spot rates from China to the US rose 10% in a month to $4 per kg and by 15% from south east Asia to the US to $3.61 per kg due to a sharp growth in chargeable weight month-on-month.