Data for July says that volumes have fallen 2% month-on-month and spot rates are down 40% year-on-year for a 4th consecutive month.

Capacity in July was up 7% on last year as airline summer schedules increased to meet passenger demand, which put the dynamic load factor at 55%, on par with June and 3 percentage points below a year ago.

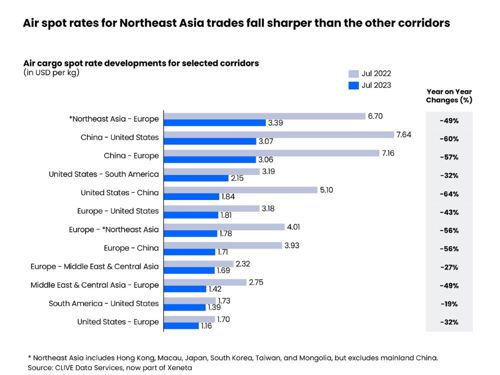

Increased capacity is putting pressure on rates, which were down 41% compared to last year with an average of $2.20 per kg compared to $2.31 per kg in June.

Niall van de Wouw, Chief Airfreight Officer at Xeneta says July rarely provides an unexpected performance so the declining rates will be a concern for airlines and forwarders.

He says shippers are relaunching contract negotiations with logistics service providers to push down rates and are looking at longer, 12-month commitments to reduce their costs.

Van de Wouw comments, “The airfreight rates merry-go-round will be intense this winter, as we have indicated in previous months’ analyses. Many freight forwarders, who at the peak of the pandemic chose multi-year contracts to secure airline capacity, are now reportedly bleeding cash, so they are under significant pressure to renegotiate rates which reflect the reality of today’s freight market and the expectation that the current market environment could continue for the foreseeable future into 2024.”

Volatile conditions have been reflected in Q2 results with the top 3 airfreight forwarders – Kuehne + Nagel, DHL Global Forwarding and DSV all reporting airfreight revenue contracting around 50% compared to last year.

Forwarders targeting higher yield clients and commodities are gaining higher margins but those focused on getting volumes at almost any cost to gain market share are sacrificing their margins to do so and likely causing spot rates to fall further than expected.

Xeneta expects airfreight volumes to remain muted for the rest of the summer, citing China’s manufacturing Purchasing Manager Index data indicating a continuing decline in manufacturing and new export orders remaining subdued.