In its May market update, Xeneta reports that global air cargo volumes rose by 6% in May, helped by the US-China 90-day tariff truce announced on 14 May after retaliatory tariffs were escalated from April.

The US administration lowered additional tariffs on China from 145% to 30% while China responded by decreasing its tariffs on the US to 10%.

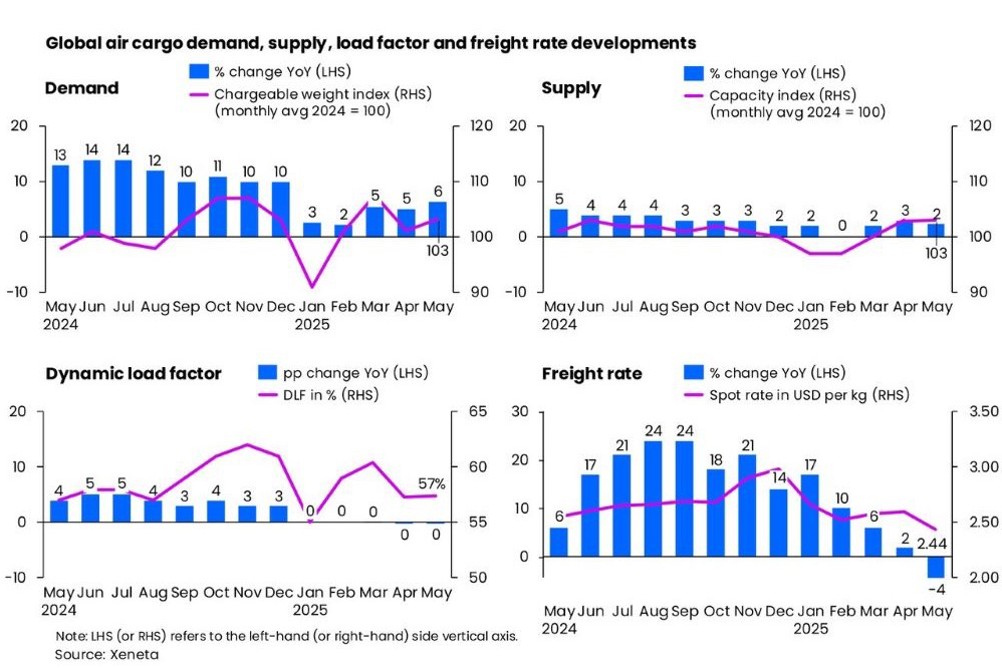

The news came too late to reverse a softening in freight rates, which fell 4% year-on-year in May to $2.44 per kg, the first decline since April 2024.

In part, this could be attributed to a near 20% year-on-year decline in jet fuel costs and more downward pressure could lie ahead, says Niall van de Wouw, Chief Airfreight Officer of Xeneta.

He said: “Market fundamentals are holding up, but the drop in rates is likely a reflection of declining sentiment and concerns, particularly among airlines, over what will happen once more stability returns to international trade and there is less of a push for the security of airfreight. Whatever worse trade conditions take away from overall trade, this uncertainty gives a bit back to airfreight.”

Airfreight is getting a temporary piggyback in the current climate of reduced trade due to emergency shipments but this will not continue, warns van de Wouw.

He said: “At the moment, the climate might be positive on certain lanes to airfreight demand, but there will be a time when there’s an agreement on tariffs – and I don’t expect the end result to promote trade and will, therefore, hamper airfreight.”

With rates going down, van de Wouw says there have been short upticks but the overall trend is that rates are going down and are likely to continue to fall.

He thinks airlines will try to hold onto their volumes in an uncertain environment and will be willing to pay a little bit more for security.

Commenting that the FOMO seen in 2023 may be back, van de Wouw said: “So, the moment flights become less full, airlines might just want to settle their rate negotiations a little bit quicker and more keenly – and I think we’re seeing that starting to play out in the negotiation of rates at a global level.”

Global demand was one percentage point higher month-on-month in May due to the effects of April’s de minimis announcement, which saw the sudden removal of the de minimis threshold on shipments from China and Hong Kong into the USA.

Some calm has returned to the market with the USA lowering tariffs on Chinese and Hong Kong low-value e-commerce shipments to 54% or a flat fee of $100 for parcel shipments.

Cross-border e-commerce giants like Temu and Shein are expected to face the general 30% tariffs as they traditionally use commercial airlines for international airfreight before using local postal networks for last mile deliveries, indicating they may retain a competitive advantage if incremental taxes increase 40-50%.

The outcome is important for air cargo as e-commerce volumes accounted for 50% of China-USA airfreight in 2024.

The uncertainty is benefiting airfreight but not trade as plans that were made a few weeks ago are now obsolete, says van de Wouw.

He said: “Supply chains are a mess and with all this disruption, we’re seeing goods moving by airfreight that typically wouldn’t be flown. That’s due to the uncertainty.”

The market must prepare for more surprises as tariffs as they are being applied quickly and are unpredictable.

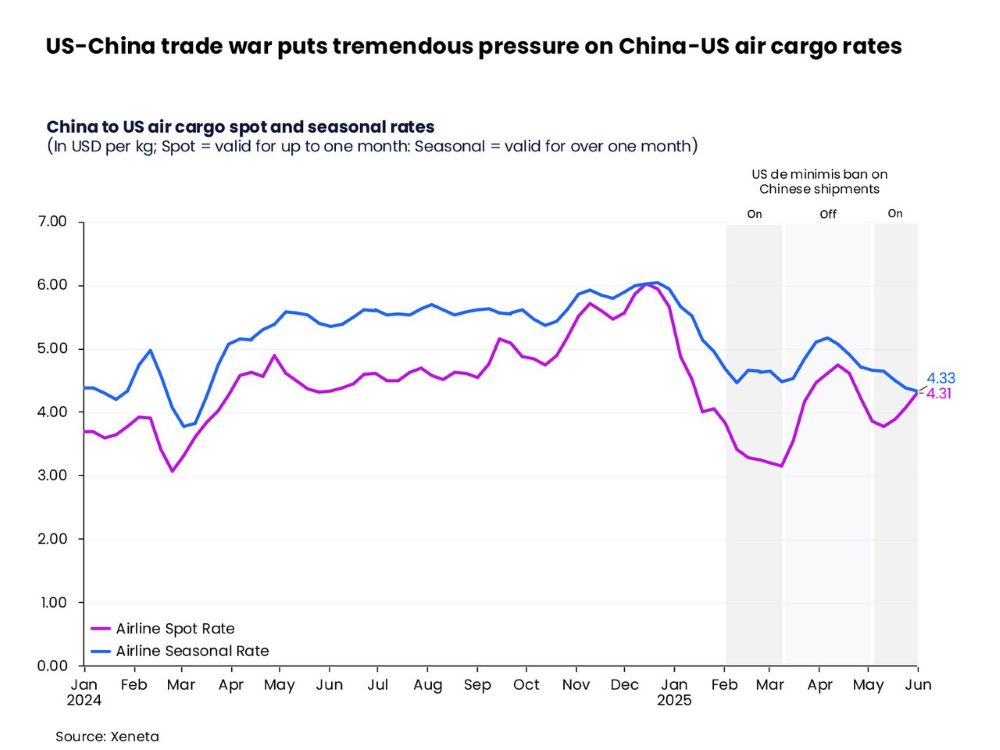

By the week ending 1 June, China-USA spot rates rose 14% to $4.31 per kg, up from their low point in the week ending 11 May.

Despite the uptick, seasonal rates continue to trend downwards from their early April peak prior to the US Liberation Day on 2 April, signalling ongoing caution in the mid-term market outlook.

Prior to the implementation of de minimis tariffs in the USA, Chinese customs that low-value and e-commerce shipments from China to the USA surged 30% year-on-year in April, outperforming the 6% increase in the first quarter.

The 30% surge was behind the 45% increase in China’s overall cross-border e-commerce sales, indicating sales are being diverted elsewhere.

Global air cargo capacity increased by 2% year-on-year in May as belly capacity served the Northern Hemisphere summer season.

The global dynamic load factor remained at 57% for the fifth consecutive month in May.

The 90-day tariff truce is due to end on 9 July for most countries and 13 August for China, which is likely to cause a short-term surge in cargo demand due to mounting concerns over a potential breakdown in trade talks or new duties such as the USA threatening a 50% tariff on goods from the EU.

Xeneta says the ocean market could shed light on the outlook for airfreight with 40 foot container freight rates from China to the US West Coast jumping to more than $6,000 per FEU despite a considerable reduction in blank sailings by carriers.

The US International Court of Trade has ruled that President Trump’s tariffs are unlawful but they remain in place during the legal battle, casting further uncertainty for global trade.

The EU plans a €2 fee on small parcels entering the bloc, which will apply to parcels valued under €150 sent directly to consumers from outside the EU.

Parcels routed through EU-based warehouses will have a reduced fee of €0.50.

Van de Wouw said: “The sentiment we saw in May may be preluding market fundamentals, leading to less demand, falling rates, and lower load factors. But one thing is clear; the airfreight market will get through this. We just don’t know how long it will take. Industry professionals are going to need a lot of energy to work in this environment, but it’s also a time to be respectful of all stakeholders.”