Global air cargo demand increased by 11% year-on-year in February, following the same growth in January, pushing the average global cargo spot rate 2% in a month to $2.29 per kg in what is traditionally a slower time for volumes.

Xeneta says this is different from pre-pandemic trends when spot rates would decline following the year-end peak season and immediately after the Lunar New Year before rebounding towards the year-end holiday seasons.

Niall van de Wouw, Chief Airfreight Officer of Xeneta, says, “It’s a surprising start to the year from a volume perspective, and not something people would have expected, ourselves included, with demand much higher than it was a year ago. Generally, we wouldn’t expect to see a rate uptick at this time of year. This is likely related to the Red Sea disruption, but this is not the only factor.”

He adds that signals suggest inflation is not cooling because consumers are still spending and where they are spending is having more of an impact than how much they spend.

Consumers are buying on e-commerce platforms, which is benefiting air cargo and means e-commerce is making up over 50% of revenue out of East Asia for some airlines, says van de Wouw.

He says, “We now wait to see what impact the airline’s summer schedules will have as well as what happens next in the Red Sea. We would certainly expect to see a downward pressure again on rates once the summer belly capacity returns in the western hemisphere as well as China, where the travel recovery is by no means yet done.”

Cargo traffic measured in chargeable weight rose 10% month-over-month, pushing the global dynamic load factor up 4 percentage points to 60% in February while capacity remained relatively unchanged.

The average general cargo spot rate and increasing volumes are most likely a response to disruption in the Red Sea and e-commerce demand from China.

Some operators have imposed short-term embargoes on import traffic from Asia to help clear backlogs caused by the sudden surge in air cargo volumes, which has outpaced the growth of supply for the fourth consecutive month.

The Red Sea conflict has affected ocean container shipping with recent declines in ocean container spot rates also being impacted by falling ocean schedule reliability for Asia to Europe trade, which was 39.4% in January, the lowest level since October 2022, according to Sea Intelligence.

This has contributed to increased air cargo demand for shippers willing and able to bear the higher cost of airfreight to maintain supply chain resilience.

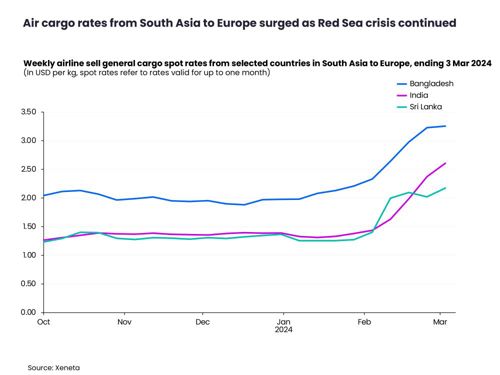

Disruption in the Red Sea caused air cargo demand to increase 18% from January to February on the South Asia to Europe market, pushing up the average spot rate 34% in a month to $2.15 per kg.

Several countries saw large increases in spot rates with India up 81%, Bangladesh by 40% and Sri Lanka by 55% in the week ending 3 March compared to 4 weeks earlier.

The China to US spot rate was up 15% from January to February to $4.12 per kg and the spot rate only fell 2% in the week ending 3 March compared to the week ending 11 February.

Cross-border e-commerce continues to drive demand for air cargo out of locations such as Guangzhou and Hong Kong with market intelligence indicating some shippers are looking for alternative hubs to avoid congestion.

Van de Wouw says conversations with shippers suggests many are looking at derisking supply chains and avoiding hubs dominated by e-commerce behemoths so their products get to Europe in time for Spring.

He says, “If they’re stuck in a sea container because of longer lead times, and you miss this opportunity, the subsequent mark down in the product cost is likely greater than the cost of switching from sea to airfreight. This is shaping the market – but we also know the market will probably surprise us again in the coming weeks.”

Van de Wouw also says airlines, forwarders and shippers are monitoring market trends as airlines prepare to launch their summer schedules at the end of March.

Capacity on the transatlantic air cargo market traditionally increases 50% due to summer travel demand, which is expected to put pressure on rates on Europe-North America corridors and flows that use European hubs as transit points.