Picture credit: Xeneta

The global air cargo market is heading towards a "hot Q4" after registering 13% year-on-year growth in chargeable weight, the sixth month of double-digit growth, while capacity has only increased by 3%.

The global dynamic load factor measuring capacity utilisation based on volume and weight of cargo flown alongside available capacity has increased four percentage points.

Xeneta says June’s figures look strong against weak results this time last year, saying double-digit growth is unlikely to continue due to the way the market picked up in the second half of last year.

Niall van de Wouw, Chief Airfreight Officer of Xeneta, says, “June’s growth in demand was not surprising and we would expect to see a continuation of double-digit year-on-year growth in July and August because of low demand in the same months last year. The global machine is humming along nicely at this level – but this is likely the calm before the storm in terms of air freight rates.”

He adds that he has heard certain airlines and forwarders are considering implementing peak season surcharges by the end of August due to the strong demand.

Looking into the peak season, van de Wouw says shippers and forwarders with capacity agreements based on fixed volumes and a peak surcharge will have reduced risks while those dependent on the spot market can expect to pay a hefty premium.

“In 2023, the market did not anticipate the demand we saw. This year, it does. Shippers with capacity agreements in place will be better prepared, but if they go above the agreed upon threshold, they will face paying market rates. On the short-term spot market, this could mean +50% increases in rates above what we see now, once the market really heats up,” he says.

The e-commerce boom, ocean freight disruption and increased manufacturing activity were the main drivers of air cargo spot rates in June, which were up 17% year-on-year to an average of $2.62 per kg and 2% month-over-month.

From south east Asia to Europe and the US, spot rates increased by 14% month-on-month to $3.65 per kg and $5.32 per kg respectively in June.

Northeast Asia to Europe was up 5% to $4.26 per kg and to the US increased 4% to $4 per kg.

China to Europe and China to the US both dipped 1% to $4.09 per kg and $4.80 per kg respectively.

Europe to US spot rates were down 4% to $1.69 per kg due to extra belly capacity for summer passenger flights.

Xeneta says there are market uncertainties ahead with the latest manufacturing Purchasing Managers’ Index (PMI) reporting manufacturing production growing at a slower pace in June with its subindex of new export orders showing the first decline in three months, which coincides with soft retail sales in the US and Europe despite cooling inflation.

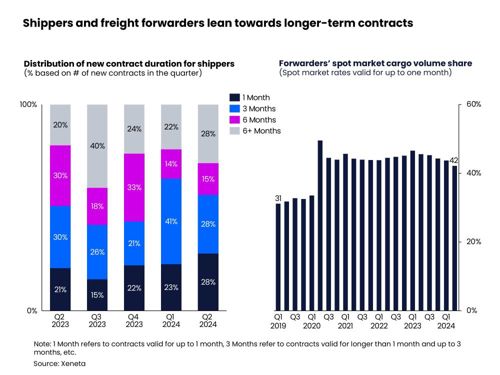

Shippers are adjusting their contract lengths with the share of contracts lasting more than six months rising to 28% in the second quarter to avoid extreme rate fluctuations anticipated for the peak season.

The decrease in three-month contracts suggests that shippers are uneasy about renegotiating rates just before the year-end peak season.

Freight forwarders are also procuring lower volumes on the spot market, which accounted for 42% of the market in the second quarter, down three percentage points on last year.

Van de Wouw says, “As we head into the second half of the year, it might be now or never to consider longer-term contracts. With a mix of ocean shipping chaos, an upturn in manufacturing activities, and fear-of-missing-out, a delicate balance of short and long-term contracts is on everyone's mind. Only time will tell, but whatever happens, you’re going to be paying a lot more to ship goods from Asia Pacific once September comes.”