Picture credit: Xeneta

Global air cargo demand rose 11% year-on-year in March, outpacing capacity which grew 8%, causing the dynamic load factor to increase to 61%.

The average global airfreight spot rate in March increased 7% from February to $2.43 per kg.

Niall van de Wouw, Chief Airfreight Officer of Xeneta says the first quarter has been surprisingly busy for the airfreight market, especially compared to the lower demand last year and the data does not indicate the market is running out of steam.

He says, “The question is, should we be surprised by it, or should we get used to it? Although the market didn’t benefit immediately, the Red Sea disruption was clearly a factor in these latest figures. Airfreight growth was primarily driven by increased volumes from the Middle East and South Asia as shippers shifted services from ocean to air to avoid Red Sea delays. We also cannot underestimate the importance of e-commerce growth, which shows no sign of abating on its most prominent lanes.”

Air cargo rates from the Middle East and South Asia to Europe registered a large increase due to rising demand caused by Red Sea concerns with average spot rates in March 46% higher than in February at $2.82 per kg and 71% higher than last year.

Average air cargo spot rates out of India to Europe in March rose 68% month-on-month to $3.38 per kg.

The Middle East and South Asia to US trade lane saw average spot rates of $4.03 per kg in March, up 35% month-on-month and 51% year-on-year.

In comparison, spot rates from Europe to the US only increase 3% month-on-month to $2.12 per kg due to being less impacted by the Red Sea.

Spot rates out of China were lower than in February as the market cooled down after the Lunar New Year with China to Europe rates down 3% month-on-month to $3.64 per kg.

This was 5% higher than last year due to strong e-commerce demand and the modal shift away from the Red Sea.

China to US spot rates fell 2% in a month to $4.06 per kg and were up 15% on last year due to growing e-commerce demand and the delayed recovery of belly capacity.

The data shows freight forwarders are purchasing volumes on the spot market to keep their options open pending an anticipated cooling down of disruption in the Red Sea and to benefit from the traditionally more imbalanced demand/supply ratio caused by higher belly capacity at the start of the summer season.

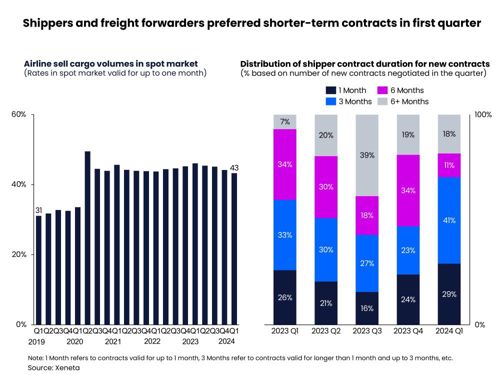

In the first quarter, spot rates accounted for 43% of the market compared to 31% before the pandemic as freight forwarders take short-term risks in the spot market in the hope of longer-term gains.

Shippers are also moving away from long-term contracts with three-month contracts accounting for 41% of newly negotiated contracts in the first quarter, up 18 percentage points from the previous quarter while six-month contracts declined 23 percentage points versus the previous quarter.

Van de Wouw says the first quarter was stronger than expected but there will be more capacity in the second quarter, which is likely to apply pressure on load factors and rates on corridors not affected by rising e-commerce volumes and the Red Sea disruption.

He says, “But this is now six months in-a-row that the air cargo market has been stronger than we expected. When is it going to slow down? Only time will tell but, right now, airfreight demand is surprisingly resilient.”