The industry analysts released their April figures today (Friday 2 May), the same day as the USA started subjecting low-value products from China and Hong Kong to high tariffs.

From today, they will be subject to 145% tariffs with products sourced from postal services paying a different 120% duty of the product’s value or a $100 flat fee, rising to $200 on 1 June.

Over the last 10 years, US consumers have paid no duty on shipments of $800 or less, resulting in the volume of cross-border packages into the USA to soar to 1.35 billion annually.

Other countries have similar exemptions at a lower value.

E-commerce accounts for 50% of air cargo shipments from China to the USA and around 6% of global volumes.

Carriers will face capacity planning challenges if there is a large drop in demand and there are reports of freighter flight cancellations and potential redeployments to other trade lanes.

E-commerce giant Temu has reduced its US advertising spending and global air cargo, which has depended heavily on e-commerce since the pandemic ended, will feel the effects far beyond the US borders, warns Niall van de Wouw, Chief Airfreight Officer of Xeneta.

He says decreased transpacific demand will have a big impact and so will the redeployment of capacity on a global level.

“This may be a year when we grow weary of seeing the word ‘unprecedented’ in market performance statements. The macroeconomic picture will depend on how long the uncertainty lasts and what will be at the end of it, but the outlook currently looks quite daunting,” he said.

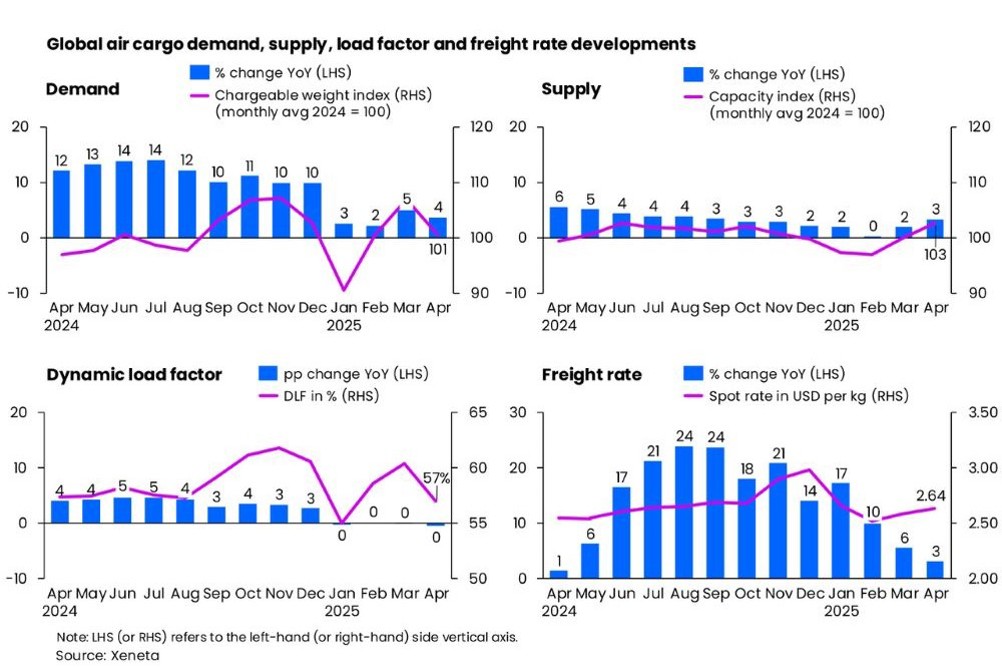

Global air cargo spot rates increased by 3% in April, the second consecutive month with a single-digit increase, which aligns with weaker demand trends.

Jet fuel prices fell by 24% year-on-year in the first three weeks of April, which was driven by economic and political uncertainty, and likely played a role in tempering spot rate growth.

Available capacity increased 3% year-on-year in April and the dynamic load factor decreased by three percentage points to 57%.

US tariffs implemented 2 April, known as Liberation Day, prompted a rush of air shipments from several Asian countries to North America, leading to a double-digit increase in spot rates and volumes.

Spot rates from Southeast Asia to North America increased by 13% month-on-month and there was a 10% rise from Northeast Asia.

The gains were reversed in the second half of April following the announcement of a 90-day tariff pause and 145% retaliatory tariffs on China.

The North America to Northeast Asia lane had the largest surge in spot rates of 14% as shippers rushed export orders to China and Hong Kong due to fears about reciprocal tariffs.

Spot rates between the Middle East & Central Asia and Europe were flat month-on-month but down into Europe by 26% year-on-year as supply pressures from the Red Sea disruption eased.

Transatlantic westbound rates declined 7% from March due to increased belly capacity from summer flight schedules, seasonal slowdowns during the Easter holidays and potential US tariff actions.

On the Northeast Asia to Europe lane, fronthaul rates into Europe increased slightly month-on-month and were up 10% year-on-year.

Backhaul rates were down 17% year-on-year as trade imbalances persisted.

April’s data did not provide indicators for the year but the de minimis rule changes will affect May’s figures with van de Wouw saying: “Nothing has really changed in the past month. The global air cargo market is in an intermediate state. It’s very difficult for companies to relocate their sourcing to avoid tariffs, but they are looking at ways to reduce the impact, still not knowing what the final impact might be. The big question for everyone is what will this year do?”

At the end of 2024, air cargo demand was predicted to grow 4-6% in 2025 but recent developments make predictions impossible.

Van de Wouw said: “The likelihood of lower airfreight rates are better news for shippers and forwarders but if shippers can’t sell their goods because of tariffs, that’s bad news for the macroeconomic picture and the need for airfreight. For most airfreight shipments, lower rates will not compensate for the tariffs that will have to be paid.”

He says all eyes are on e-commerce and this is time period is the calm before the storm as the de minimis rule changes are likely to negatively impact airfreight volumes from China to the USA.

“The traditional airfreight market will not be able to compensate for the decline in e-commerce volumes. Airlines will adjust their networks to this new reality and this, in turn, will have a beneficial impact for shippers around the world as they will see more capacity coming (back) to their market – but they still need viable trading conditions to enjoy the benefit of this opportunity,” he said.