Demand in December was up 9% year-on-year and the global average spot rate peaked at $2.60 per kg, up 6% on November, reaching its highest level in 9 months.

Niall van de Wouw, Chief Airfreight Officer of Xeneta says the geopolitical environment and cost of living pressures continue to challenge global trade but the predictability of air cargo means the industry is benefiting from international disruption, though only producing modest gains in volumes.

He says, “To say 2024 is a ‘new dawn’ is perhaps a little too optimistic, but I certainly think it’s the start of a new cycle for airlines and forwarders – and shippers are likely to also appreciate the stability returning to the market so they can more accurately predict the transportation costs for the products they are selling.”

December 2023 was busier than expected but not too much should be read into the results, Christmas and New Year make it an unusual month and December 2022 was a particularly low comparison month, says van de Wouw.

He says, “This latest data appears to reflect stronger but temporary local market performance on key lanes as opposed to signalling a global economy that is doing much better. Our market outlook forecast for 2024 remains unchanged with an anticipated +1-2% growth in demand, and a +2-4% rise in supply.”

Due to cost of living pressures, consumers opted for discounted e-commerce shopping for their Christmas shopping, which added export volumes from Asia while general retail sales outside of e-commerce remained subdued.

The dynamic load factor dropped 1 percentage point in December from November to 59% but was 3 percentage points higher than December 2022.

The general spot rate from Europe to the US increased 21% month-on-month to $2.42 with reduced capacity pushing up rates.

Rates from China and south east Asia to Europe were both up 9% to $4.49 per kg and $2.91 per kg respectively.

The ocean container shipping disruption in the Red Sea and through the Suez Canal has yet to influence air cargo rates as increased demand for the holiday season was close to its end by the start of the events.

E-commerce demand helped spot rates from China to the US increase 6% to $5.12 per kg and rates from south east Asia were up 14% to $4.50 per kg as outbound shipments tend to transit via other Asian countries before heading to the US.

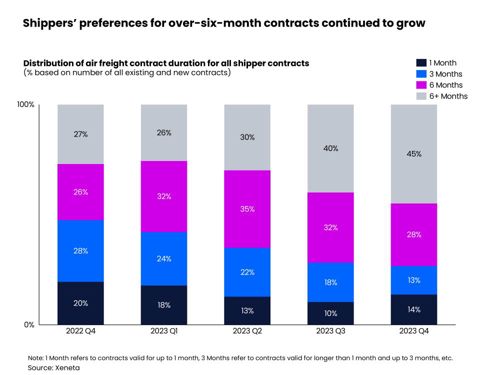

As market conditions are expected to normalise, more shippers are committing to long-term contracts, with contracts lasting over 6 months accounting for 45% of the total contracts signed, up 5% from the previous quarter.

Six-month contracts amounted for 28% of the market, which is a contrast to the pandemic when most shippers only had rates that were valid for up to a month.

The number of shippers selecting contracts with rates valid for up to a month has fallen from 20% in Q4 2022 to 14% in Q4 2023.

Van de Wouw says there is friction in global supply chains and if ocean carriers are not going through the Red Sea, it could delay more than a million containers and no one knows how long the disruption will last so some will opt to the predictability of airfreight.

He says, “The overall outlook for supply chains in 2024 remains very difficult to forecast amidst all this market uncertainty. This is generally not good for investments and shippers/consumers alike, but it might be good for airfreight’s share of global trade.”